Renewable Energy– the winners from COP21?

Helene Winch, investment strategist at Low Carbon, discusses the post COP21 environment and key outcomes

The Paris Climate Change Summit (COP21) saw world leaders and large businesses gather to decide upon a global deal to help mitigate the negative effects of climate change. Amongst the key outcomes of this conference was a landmark deal, agreed by all 195 nations, which commits governments to “holding the increase in the global average temperature to well below 2 degrees above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5 degrees above pre-industrial-levels”.

From COP21 it was plain to see that real progress is being made. It isn’t just governments and multinational businesses that can lead the way in making ‘carbon neutral’ pledges. All sectors and areas of industry across the world can make sustainable changes to help fuel the low carbon economy.

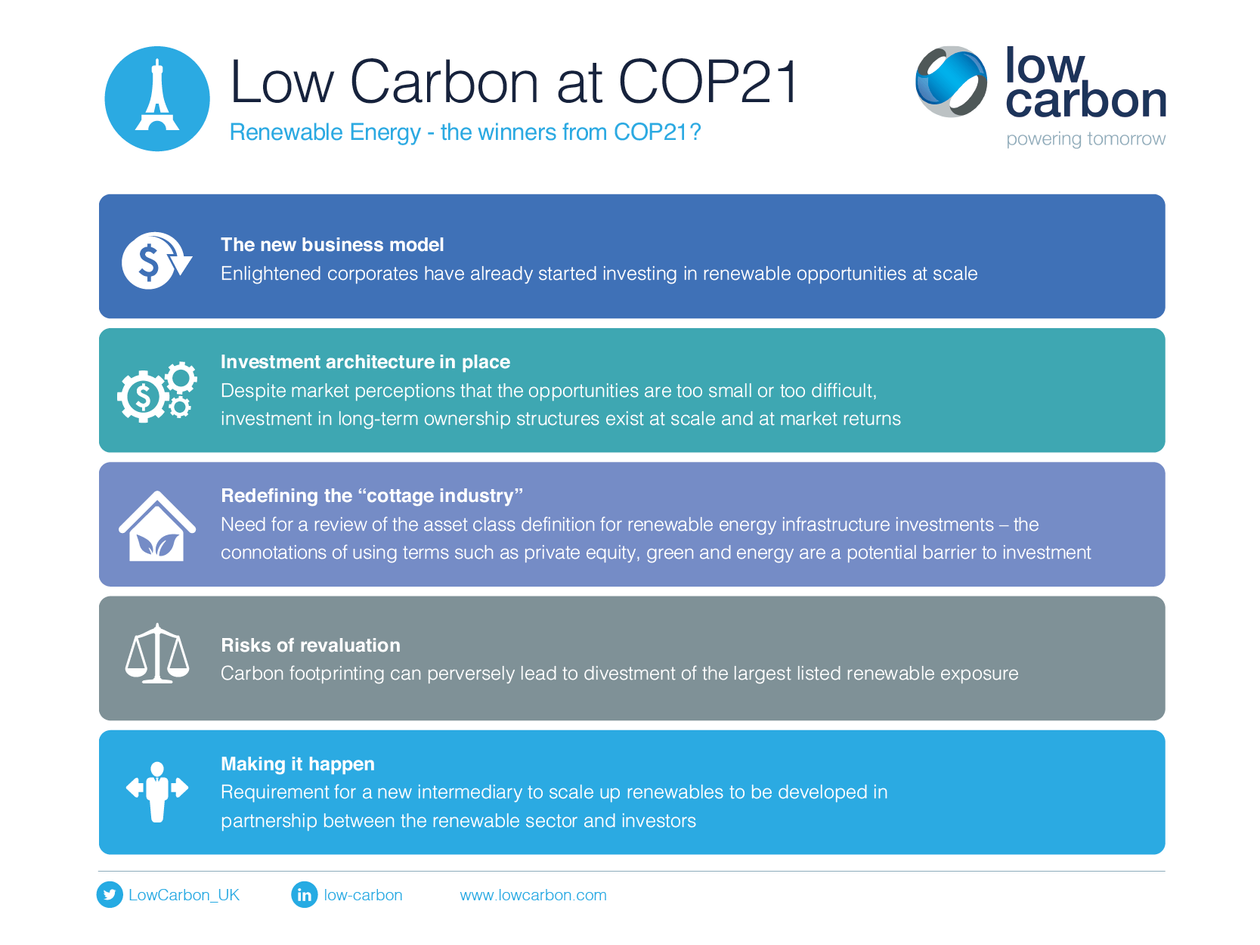

Highlights from Low Carbon’s attendance at COP21 included:

- Hearing how enlightened corporates have already started investing in renewable opportunities at scale with the likes of IKEA and Google investing 2GW and installing 650,000 solar panels respectively

- Understanding that investment opportunities in long-term ownership structures exist at scale and at market returns, despite market perceptions that the opportunities are too small or too difficult

- Recognising the need to review the asset class definition for renewable energy infrastructure investments – the connotations of using terms such as “private equity”, “green” and “energy” all potentially representing a barrier to investment

- Acknowledging that Carbon footprinting can perversely lead to divestment of the largest listed renewable exposure as these often exist within the large diversified oil majors

- Identifying the requirement for the development of a new intermediary to scale up renewables in partnership between the renewable sector and investor

During the Paris Climate Summit, Low Carbon hosted a series of roundtables attended by leading finance and energy sector stakeholders. Three areas came to the fore from these interactive discussions:

- Analysis is needed of the issues driving the shortage of climate finance is needed despite the fact that many investors have found attractive climate investment solutions with strong returns. Increased investment flows are required throughout the investment stages of development, construction and ownership (the final stage of who are the long term owners a current constraint). It needs to be highlighted that renewable infrastructure provides liability matching, cashflow positive returns.

- Barriers such as government policy risk, the perception that there is a lack of investment opportunities, investor conservatism and the lack of suitable investment mechanisms must be addressed if climate finance is to increase

- Solutions including the creation of a new asset class using terms such as “secure inflation-linked income assets” and avoiding the negative connotations of the words like “Green” or “Energy”. The sector agrees that there is a market opportunity to create a new investment platform offering aggregation and low cost, long term, efficient investments in renewable energy opportunities at scale.

With the strong Paris Agreement achieved at COP21 and the clear message sent that renewables are material, profitable and here to stay, we very much expect an increased flow of finance into renewable energy infrastructure in 2016.